Some states in the USA charge an additional sales tax depending on which city the customer lives in. If your business is located in an area where you need to calculate these additional local taxes you can set them up by clicking the Edit Local Tax Rates link on the page Configuration->Taxes.

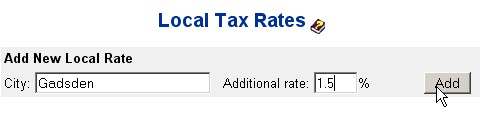

Enter the name of the city for which there is an additional tax in the box City and the tax rate in percent in the box Additional rate. Click Add to save this local tax rate to the list.

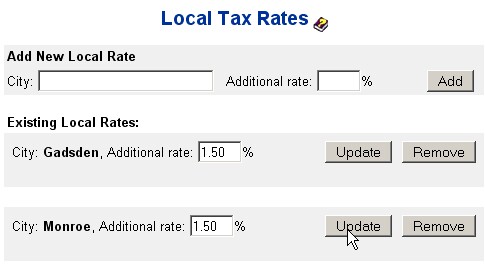

All local tax rates that you save will be added to a list and can be updated by changing the tax rate and clicking the Update button.

When a customer from the area defined in this table buys from you the additional rate will be added to the sales tax. For example, if you are located in Florida and a customer from the Monroe area of Florida buys an item the sales tax will be the 6% you have defined on the Taxes configuration page plus the 1.5% local tax rate, a total of 7.5%.